-

8 Save Money Tips

Good day! If you are anything like me, you know it can be difficult to save money. Since I started this blog, I have become more conscious of tracking my money and how I spend it.

I am also not a “spring chicken” anymore…AND I would love to be able to retire early so I have begun to focus on saving for retirement. I wish I could go back and tell my 20-year-old self to start saving for that, but better late than never!

I am always looking for new ways to save money. If you are reading this, I imagine you are too, so I have put together a list of save money tips and hopefully these can help you save some moula!

1. Do You REALLY Need It?

First things first, take a look at things you are paying for on a monthly basis, and ask yourself questions like “Do I use this enough to pay for it?”, or “Is the money I’m paying for this worth it?”, or even “Is there a way I can reduce this cost?”.

Let’s start with the first question, “Do I use this enough to pay for it?”. Maybe you have a gym membership that you rarely use or a streaming TV service (Netflix, etc.) that you don’t use enough, or maybe even a phone landline that you don’t really use because you get most calls on your cell phone.

Question two, “Is the money I’m paying for this worth it?”. This could pertain to the gym membership, once again. Is your gym membership expensive? Do you go enough for that money to be worth it? Can you buy equipment or workout DVDs to workout at home? Could you get outside and be active with walks, bike rides, etc.?

This question could also pertain to something like cable TV, or any monthly subscription service really. Cable TV subscriptions have sure gone up in price. I cancelled mine several years ago now because I realized I was down to mostly just watching one show on there. I decided that paying all that money for ONE show was not at all worth what I was paying per month. So away my cable TV went!

And finally, question three, “Is there a way I can reduce this cost?”. So let’s say that you have cable TV, and you just don’t want to give that up, is there a way you can reduce the cost of it? Do you really need the full premium package? Can you call your provider and see if they can reduce it for you with some sort of deal (I do this every so often with my internet provider)?

This is one of those save money tips that can potentially save you hundreds per year and although some of it may be a sacrifice, it might end up being worth it for you!

2. Extra/Unexpected Income

Every now and then, we get a little “bonus” income. This could be money that comes from a work bonus or raise, overtime at work, income tax refund, or even birthday money.

This is one of the easier save money tips because it’s like a bonus that you are not used to having to budget. That makes it easier to put away in savings.

The best is when you get a raise at work because that will be extra money coming to you regularly. Every time you get a raise, pretend you didn’t, and save that extra dough.

A lot of us have the mindset that when we get extra unexpected money in our pockets, that we do something fun with it. I totally get that 100%. I used to be that way, and admittedly, the odd time still am. However, I have changed my way of thinking and now have the mindset that makes me want to put every dollar I can into debt or savings.

3. Eat & Drink at Home

This can be one of those save money tips that we don’t want to give up, am I right? Well, even if we start out small, we can save. By that I mean is let’s say you tend to eat out, or go for drinks four times a month. Start by cutting that in half and only go two. Take that money for those other two times you would have gone and put it in savings. Or…

Let’s say you buy yourself lunches at work a lot, either cut that out completely or cut it down and bring a lunch either all of the time or at least some of the time. Way cheaper!

Lastly, if you stop at your fave coffee place to grab your morning java, that really adds up. For me, if I were to do that where I live, it would be $2/day. For five days a week, it’s $10, which is $40/month. That’s almost $500 a year just on coffee! Of course it’s way cheaper to buy it from the store and slap it in a thermos.

4. Challenge Yourself

Giving yourself a challenge can be more of a fun way to save money. Last year, I did what’s called the 52-week savings challenge, and was able to save up money to pay for part of my flooring that I needed to replace in my home. My boyfriend and I did that challenge together, and we both had fun doing it.

You can also simply do challenges where you give yourself a certain amount of spending money to live on for a month, or every payday, but make it a challenging number and see if you can do it. You’d be surprised on what you’re willing to give up just to “win” your challenge!

5. Got Stuff You Don’t Need?

Many of us have belongings that we no longer need or use, or even wear. You’d be surprised the things that sell online. What’s that saying, “One person’s junk is another person’s treasure”?

Also, because of the pandemic we are in, people are shopping online and trying to spend less (on second-hand items) more than ever before!

So, go through your things, take some photos (the more, the better), and throw them up on eBay, or Amazon, or even your local online listing website and make some extra cha-ching!

6. Grocery Shop Less

I don’t know about you, but when I go to the grocery store, I tend to buy “extras” every time, especially if I’m hungry when I go. I find that when I go to the grocery store once per week, I spend less than if I go 2-3 times per week.

Side note: When you make a list, STICK TO IT. Make yourself stick to it. If you have kids, it might be best to leave them at home. If they’re anything like mine, they’ll be asking for everything under the sun in the store. Parents, you know exactly what I mean.

Check out this post for saving money on groceries.

7. Nix That High Interest Debt

Any debt with high interest may be weighing you down, so to speak. Many credit cards have high interest rates. Paying those off is one of the most rewarding save money tips I can give here.

Once I paid off my credit cards, both 19.99% interest, I felt so much better about my financial situation. At one point, I was paying over $400/month just in interest which was frightening to me.

So, depending on how much interest you are paying towards high interest debt, this can be a huge savings in itself once it’s paid off.

8. Make “Money Time”

A huge realization to what and where I was spending money was a life changer for me. I sat down one day, a couple years ago now, and looked at my online banking. I pay most things with my debit card so it’s easy to track.

So, I went through 6 months of my spending and realized I was spending money on things I didn’t need to be spending money on. Some of those things were several meals out, wine at the liquor store, too much at the grocery store (I knew I was over-spending there), and buying other items I did not NEED.

My point here is making time to sit down and go through what you’ve been spending money on is essential to spending less and therefore one of the most important save money tips I have listed here. It can be a real eye-opener.

There are several budget apps that you can use to help you manage your money too.

Conclusion

There are many ways you can save money. Part of that is getting in the right mindset to do so. I used to be terrible at saving, but since changing my mindset on it has helped me immensely.

Starting with even the smallest changes can help to change your mindset. Hopefully these save money tips can help you with that too.

Don’t forget, the money you save, put into a high interest savings account. That way, you get the best bang for your buck! Until next time…

-

Best FREE Couponing Apps for Canadians

The days for actually clipping coupons are pretty dead now, thanks to technology. Nowadays couponing apps and/or cash back apps are the “in thing”.

Of course we all want to save money…I mean, really, who doesn’t, right? It’s even easier now than it used to be with couponing apps. So, let’s go over a few pretty awesome ones.

1. Checkout 51

I’m a tad biased with this one because it is my favourite. They offer a wide range of coupons in several different categories.

How it works is, let’s say you buy an item from their coupon list. You add it using their “+” sign beside the item and then you redeem it by scanning the bar code and taking a picture of your receipt. Boom, done!

They also have video ads sometimes that you can watch for money. Those are quick and easy too.

Once you’ve hit the $20 mark, you can request a cheque from Checkout 51. Money back in your pocket!

2. Caddle

Caddle is a bit different because it offers more than just cash back coupons. You can also earn money by participating in surveys, uploading receipts from certain stores, referring friends and watching ads.

For the cash back couponing, you just need to take a photo of your receipt and upload it to the app. Easy peasy.

Like Checkout 51, once you hit the $20 mark, you can request a cheque from Caddle.

3. Save.ca

Save.ca makes the couponing apps list because it has several great things about it.

You not only have your mobile coupons on it, but you also have access to store flyers so you can get the best deals and price match.

You can also create your shopping lists in the app as well as add your loyalty cards in it so you don’t have to worry about fishing around and digging them out when paying.

With Save.ca, you can cash out when you get to $5 which is pretty nice!

4. Foupon

Foupon is a couponing app specifically for restaurants, whether it be fast food or eat-in. They cater to thousands of restaurants so you’ll have a fantastic selection to choose from.

While restaurants still send out paper coupons, this is a way better option to having to remember to grab your coupons on your way out, as they’ll already be in your phone! And, let’s face it, we all rarely forget our precious smartphones these days (insert wink emoji here).

A nice little bonus the app includes is that you can search for nearby restaurants close to where you are.

5. Groupon

Okay, okay, we all know about Groupon, but I needed to mention it because it just has some amazing deals on there. I know I’ve gotten many myself.

As I’m sure you know, you can get coupons on there for many different stores and shops, as well as great deals on services and even online courses. Categories range from health and fitness to retail to beauty, and so much more!

For Those Who Still Like Printables:

If you prefer the printable type of coupons over the couponing apps still, I’ve added a list of the best websites you can get those from.

Side Note: You can also check out certain food brand websites for their own coupons. Some examples are: Pillsbury, Betty Crocker and P&G Everyday.

Get started saving today with one of these couponing apps, or maybe you have your own fave. Please feel free to share any that you use and love!

-

How to Make Extra Money – 21 Proven Ways

The million dollar question, right? We all want to know, probably even more so in these hard times, how to make extra money. Whether it be because you’ve been laid off from your job, or because you just don’t make enough to get by, or even because you just want some extra spending money. We all have our different reasons. So, without further ado…

1. Fiverr

You may be familiar with Fiverr; it’s become a pretty popular website for people to sell their services if they have expertise in something.

There are many different categories on there where you can become a seller and make some extra moula. Just to name a few, you can provide services such as proofreading/editing, resume and/or cover letter writing, writing e-books, providing website content, digital marketing, voice-over work, photography or health/fitness/nutrition.

There are several other categories on there as well, so think about what you are good at and go over there to take a look and see if there is a need for it!

This dad made over $1,000,000 on Fiverr. It’s a pretty inspiring story.

2. Proofreading

If you’re asking yourself how to make extra money and you are good at spelling and grammar, then proofreading may be perfect for you.

You can offer your proofreading services to places such as proofreadingservices.com, Fiverr.com, Scribendi.com or Upwork.com, or even start your own business.

This proofreader made $30,000 in 10 months part-time.

3. Surveys

Surveys won’t make you a huge amount of money but they sure are easy-peasy to do. I personally do them and typically make $75-$100 per month, and that’s with also having a full-time job.

There are many different websites that you can sign up to that pay to complete surveys. My favourite is Swagbucks, but some other good ones are Leo/Leger Opinion, MyPoints, Survey Junkie and American Consumer Opinion (also available to Canadians).

4. Virtual Assistant

Many people want to know how to make extra money working from home/remotely nowadays, and a virtual assistant is just that.

Virtual assistants perform administrative tasks such as scheduling appointments, making/taking phone calls, etc.

In this day and age, with COVID-19 and all, the idea of making extra money while staying safely at home is what a lot of us are looking for.

Many employers these days are seeking virtual assistants with so many businesses having staff work remotely. If you online classifieds are anything like mine, you’ll find tons of employers seeking VA’s!

5. Mystery Shopper

A mystery shopper is one who gets paid to go into a place of business (whether it be a retail store, gas station, etc.) and secretly evaluate the performance of the staff, the cleanliness, etc.

I’ve done this one before. I would go into the store, evaluate everything necessary, write up my report and get paid. It was kind of fun for me actually.

Some of the best places that hire mystery shoppers are We Check, Premier Service and Shoppers Confidential just to name a few.

6. Thrift Store/Garage Sale Selling

If you like to shop and/or find a good deal, this one is definitely up your alley! Shopping at thrift stores or garage sales and reselling on Kijiji, Amazon or e-Bay, etc.

You can find some hidden gems at these places, or even things like books, text books, vintage items, collectibles or brand name items, etc. Get them at a low price and resell for a profit.

Note: It’s a good idea to check on either Amazon or eBay to see if an item you are going to purchase is in demand or not.

This is a great way to put some extra cash in your pocket. Some people actually do this full-time! This 23-year-old gave up a great job to do just that.

7. Affiliate Marketing

This is one of my favourite ways on how to make extra money. Many people do this full time, making a pretty impressive income.

What is affiliate marketing? Simply put, you receive a commission for promoting other people’s products.

This can be done through your own website or blog, or you can even promote the products other ways, such as through social media (Twitter, Facebook, etc.), YouTube or posting on forums or online communities.

Success stories can be pretty motivational to get you started.

8. Sell on Etsy

Do you consider yourself crafty? Etsy is a website to sell your creations, ranging from jewelry to home decor and so much more.

Some people make a good income on Etsy, but for most, it’s not huge earnings. However, it will also depend on how much time you can devote to it.

9. Sell on eBay or Amazon

Whether you have stuff around your house that you don’t use/need anymore, or you buy items from a thrift store, garage sale, manufacturer/wholesale or even items at a store on a great sale, selling on Amazon or eBay is a great option to earn you some extra money.

This is perfect for those who don’t have, or want, a website to sell items. With eBay and Amazon, they already have a HUGE amount of traffic, so the hard work is done for you.

I used to sell on eBay a fair amount, and I found it so exciting watching my auctions go up and up as people bid on my items. It was slightly addictive!

This is a pretty incredible story of a man who went from being in a large amount of debt to making millions selling on Amazon.

10. Pet/House Sitting

This way on how to make extra money is pretty self explanatory. If you know people who may be going away on vacation, etc., you can offer your services for a fee.

You could also advertise your services to do this on your local classifieds website, in your local newspaper, etc.

This is a great way to earn an extra bit of money but may not be something that’s going to be consistent for you if people aren’t travelling. Still, every little bit helps, so can’t hurt to give it a shot!

11. Dog Walking

Are you a dog lover? Enjoy walks? Well, this is a great way to get exercise, enjoying the company of a cute fur buddy AND making money. Pretty sweet deal I would think, right?

Some people may not always want to get out and walk their pup, or may have injured themselves or are just plain too busy.

Again, advertise your services just by simply putting an ad up on a classified website in your area, or hang some signs up, ask around, or whatever your preference.

12. Errand Service

Offering services to run people’s errands for them is a pretty simple way on how to make extra money.

Many people can’t get out due to physical disabilities/injuries, or are just too busy. You can help make their lives easier by offering to run their errands for them.

Errands can include things like grocery (or other) shopping, buying a gift for someone, delivering items, picking up/dropping off dry cleaning, picking up/sending out items at the post office, pick up prescriptions, etc, etc, etc! The sky is the limit with different types of errands.

13. Drive for Uber/Lyft

Enjoy driving and meeting/chatting with people? Driving for Uber or Lyft is a great money-making idea for you then!

This is a great flexible option because you get to pick the hours you are available. Not too shabby, hey?

Find out which of these, or other, companies are available in your area and check your eligibility.

Keep in mind that you will likely have to check with your vehicle insurance company to make sure you have the right kind for this. You may have to make some changes to it.

14. Door Dash/Skip the Dishes/Uber Eats Driver

Here is another idea on how to make extra money that is very flexible for you.

Do your day job (or whatever time of day you work…we all don’t have “day” jobs), and pick some evenings and/or weekends to deliver food in your spare time.

Depending on what is available in your area, check out Door Dash, Skip the Dishes or Uber Eats to sign up.

15. Instacart Shopper

Enjoy grocery shopping? Not everyone does, so if you do, you can help these people out. Yes, people PAY to have you grocery shop for them!

Instacart is a grocery shopping service. They pay shoppers to shop for people and deliver their groceries directly to the customer’s home.

With Instacart, you can choose to be an “in-store shopper” or a “full-service shopper”. In-store shoppers shop in the store but don’t deliver to the customer, so it’s good if you as the shopper don’t have a vehicle. Full-service shoppers shop and then deliver, which is also good because there may also be a gratuity involved from the customer for the delivery.

16. Home Daycare

Love kids? Do you have your own kids that you are staying home with anyway?

If you are great with kids and home during the day, why not consider a home daycare when asking yourself how to make extra money to put in your pocket?

This is also great if you already have your own kids that you stay home with, as they will have playmates too. It’s a win-win in that case!

17. Flip Websites

If you are tech savvy and know your way around a website, this is definitely a viable option for you to make some extra money.

Website flipping is essentially the same as flipping a house. You buy an already existing website, fix it up a bit (i.e. make some improvements), and sell it for a profit.

You can make some pretty good money doing this. Websites typically sell for about 2-3 times the amount of profit they make per year. So, let’s say you buy a website and it ends up making you $10,000, you could sell it for $20,000-$30,000. I’d say that’s pretty decent, right?

This step-by-step article goes in depth on how to flip websites.

18. Freelance Writer

Being a freelance writer means you are self-employed and can do writing jobs for any company or individual who requires it.

So, if you excel in writing, and love doing it, this is one of the perfect ways for you on how to make extra money!

People need writers for things like website or blog content, short stories, articles, resumes, social media content…the list goes on and on.

19. Sell Your Stuff

Got stuff? Sell it. Many of us are stuck at home these days due to the coronavirus, and well, if you live in a place like I do, cold weather encourages me to hibernate too. Brr. So, it’s the perfect time to go through your belongings and sell some things you no longer want or use.

My rule of thumb is that if I haven’t used it in a year, it’s gonzo! I’ve done this a fair amount since COVID-19 began, and let me just tell you how liberated I feel in doing so…and I’ve made some extra cash. Can’t go wrong.

Like me, I’m sure you have a go-to popular online website/place you can list your unwanted items on to sell them. Where I live, Kijiji works best. It’s free and easy to list items (and photos) on there.

20. Dropshipping

If you are looking for a way on how to make extra money in e-commerce, but without having to find space to store all of your products, dropshipping is definitely the way to go.

What is dropshipping?

Simply put, it’s selling products through a store (website), and the store then passes on the order to their supplier. The supplier then sends the product directly to the customer.

What is involved in the whole dropshipping concept?

It’s a matter of setting up a website, finding a supplier(s), adding products and advertising them.

Setting up a website can be relatively easy with Shopify where they’ve already done most of the hard work setting up the store for you. This is probably the most popular way, especially for newbies or people who aren’t tech-savvy.

The most popular place to find a supplier is likely Aliexpress. They have thousands of products in all kinds of categories to choose from at great prices.

Once you have your website all set up and products added, you need to advertise them and the best way to do so is to advertise on social media, whether it be Facebook, Instagram, Pinterest, Twitter, etc.

This money-making idea will take some time to get going, but it can sure be worth it in the end. Many people make a great living at it, some even quitting their day jobs to do it full time.

This 24-year-old was even able to become very successful at it smack dab in the middle of the COVID-19 pandemic.

21. Remote Jobs

Due to the pandemic, more and more employers are hiring people to work remotely from home.

From part-time to full-time work, you can find many remote jobs currently. There are specific places you can look such as FlexJobs or just look in your local job classifieds websites. Heck, they may not even require you to be local when you are just working remotely anyway.

There you have it! And hey, if you have any of your own proven ideas on how to make extra money, please feel free to comment. I’d love to hear them!

-

5 Best Cash Back Credit Cards

We all know that credit cards can get us in a lot of trouble debt-wise, BUT they can also be a good thing…if “treated” properly and we choose the right kinds. Are you picking up what I’m throwing down?

Those kinds of credit cards are the cash back kind. Today, we’ll chat about the 5 best cash back credit cards in order for you to get your best bang for your buck.

What are Cash Back Credit Cards?

Cash back credit cards pay you back a small percentage of your amount spent on your purchases. The percentage is typically between 0.5% and 3% cash back.

Example: Let’s say you bought something for $1000, and your cash back credit card gave a rebate of 2%. You would get $20.00 back. Pretty sweet deal, hey?

How Does the Cash Back Redemption Work?

How you get compensated with cash back credit cards varies with each financial institution. They may pay you once per month, once per calendar year or depending on your dollar amount spent.

You will get your rebate on your credit card statement, or some institutions will have the option to deposit it into a bank account for you.

Okay, let’s get to the good stuff…

5 Best Cash Back Credit Cards

1. BMO CashBack Mastercard

- 3% cash back on groceries, 1% cash back on recurring bill payments and 0.5% cash back on all other purchases

- No annual fee

- Welcome Offer (subject to change): Up to 5% cash back in your first 3 months and 1.99% interest rate on balance transfers for 9 months with a 1% transfer fee

- Bonuses: Up to 25% off rentals with participating National Car Rental and Alamo Rent-A-Car locations and Purchase Protection and Extended Warranty on most purchases bought with your card

- Either use your rebate as a credit on your monthly statement, or have it deposited right into your BMO chequing or savings account

Get more information on the BMO CashBack Mastercard.

2. SimplyCash Preferred Card From American Express

- 2% cash back on all purchases

- $99 annual fee

- Welcome Offer (subject to change): Earn 10% cash back in your first 4 months (up to $400 cash back)

- No limit to how much cash back you can earn

- Cash back rebate is applied as a credit to your account annually each September

Get more information on the SimplyCash Preferred Card from Amex.

3. CIBC Dividend Visa Card

- 2% cash back on groceries, up to 1% cash back on all other purchases

- No annual fee

- No limit to how much cash back you can earn

- Minimum annual income: $15,000

- Cash back rebate is at the end of each calendar year, credited to your account

Get more information on the CIBC Dividend Visa Card.

4. Meridian Visa Infinite Cash Back Card

- 4% cash back on gas and groceries, 2% pharmacy and utility bill payments and 1% on all other eligible purchases

- No annual fee for the first year (after that, it’s $99)

- Minimum annual income (personal): $60,000 or (household): $100,000

- Redeem your cash back rebates through account credit, merchandise, event tickets or gift cards on a monthly basis

Get more information on the Meridian Visa Infinite Cash Back Card.

5. Tangerine Money-Back Credit Card

- 2% cash back on 2 Money-Back Categories of your choice (add a 3rd category if you have rebates deposited into your Tangerine Savings Account) and 0.5% on all other purchases

- No annual fee

- Minimum annual income: $12,000

- No limit to how much cash back you can earn

- Rebates paid monthly to either your credit card balance or have it deposited into your Tangerine Savings Account

Get more information on the Tangerine Money-Back Credit Card.

Now you just have to figure out which of these 5 best cash back credit cards will work best for you and your needs. It’s important to note that none of these will work well for you if you carry a balance, so the key thing is to pay off any balance right away. Ciao for now!

-

What is Net Worth & How to Calculate It

One of the many, MANY things I’ve learned in my journey to get rid of my debt is that it is a very good thing to know your net worth. What is net worth? That was a question I asked myself not so long ago…

What is Net Worth?

Simply put, net worth is what you own (your assets) minus what you owe (your liabilities).

So, what you own would be things like your vehicle, house, money, personal property (art, jewelry, etc.), and so on.

What you owe would be your debt, such as credit card balance(s), student loan, car loan, mortgage, etc.

How to Calculate Your Net Worth

Now that we have answered the million dollar “What is net worth?” question, we can tackle how to calculate it. I did this not so long ago myself for the first time in my life. I always love a good challenge, and this challenges me to keep track of it in order to improve it as I continue to decrease my debt. Without further ado, as they say, let’s get to it!

In order to calculate your net worth, I’ll give you an example scenario. (I don’t know about you, but I learn best with examples.) Here we go:

List of What You Might Own (Assets):

Money in the bank – $5,000

Value of investment/retirement accounts – $20,000

Vehicle – $10,000

Value of home – $270,000

Business interests – $0

Personal property (jewelry, art, etc.) – $20,000

Cash value of any insurance policies – $0Total = $325,000

List of What You Might Owe (Liabilities):

Mortgage – $200,000

Car loan – $6,500

Credit card balance – $15,000

Student loan – $10,000Total = $231,500

Now that you’ve done the hard part, all you need to do now is subtract. Easy peasy, right?

Assets (own) – Liabilities (owe) = $93,500 (net worth)

Why is it Important to Know Your Net Worth?

We’ve discussed what is net worth and how to calculate it, but why is it important for you to know? Here are the two main reasons:

1. Your Financial State

In order to get yourself out of that pain-in-the-butt we call ‘debt’, as unpleasant as it is, you need to know where you stand financially. Ideally of course, you want to own more than you owe, but that’s not the case for everyone.

Your net worth allows you to have a picture of what your financial state actually is. Keeping track of this will allow you to see if you are moving in a positive or negative direction, money/debt wise.

So, simply put, if your net worth number starts decreasing, you will need to look at your spending habits and make some changes there. If it’s increasing, then you know you’re going in the right direction.

2. Where You Want to Be

Your net worth will help to show you where you are financially, but will also allow you to identify what needs to be fixed in order to achieve a better status for yourself, whether that is getting rid of debt, saving for retirement, an emergency fund, or all of the above!

The best way to get your net worth on the right track, is to increase your assets (what you own), and decrease your liabilities (what you owe).

To Conclude

Now that we’ve tackled exactly what is net worth and the way to calculate it, we can start on getting ‘er done!

Even if you are starting off with a negative net worth (more liabilities than assets), don’t let that discourage you and think that you’ll never get there. You can, and will, if you keep with it.

Please feel free to drop me a line on this. I’d love to hear from you!

-

15 Ways to Create Passive Income

As I mentioned in my last post, I have become extremely interested…okay, actually downright excited…about the idea of finding ways to create passive income for myself. I mean, who doesn’t want to make money while they sleep, am I right?!

What is Passive Income?

Passive income is money you earn with little or no maintenance from you. Most passive income will require work in the beginning, some more than others, but eventually will require very little, or no, effort.

Did You Know?

Most self-made millionaires have multiple streams of income. A little bit of trivia that I found in my research on ways to create passive income. Okay, let’s get to the good stuff…

1. Investing in Dividend Stocks

If you have a bit of extra money to do so, investing in dividend stocks is one of the easiest ways to create passive income.

I, myself, got into buying dividend stocks awhile back, because I am wanting to build them up to be as high a dividend as they can when it’s time for me to retire. I also like the idea of retiring early so that would be some pretty nice “icing on the cake” so to speak.

If you are not familiar with what dividends are, they are an extra little “reward” that some companies pay to their investors either on a monthly or quarterly basis generally.

If you are interested in getting into investing though, make sure you do your homework. Learn about investing, learn about the companies you would like to invest in (their success, if they’ve always paid investors their dividends, how long they’ve been around, their financial statements, etc, etc, etc.).

So if you are interested in investing in the stock market as passive income, dividend stocks are the way to go!

Note: I am not an investment professional, so again, do your homework if you are looking to get into investing.

2. Investing in Real Estate (Through REITs)

Who says you have to go buy a physical property and have the hassle of renting it out to potentially bad tenants in order to eventually profit? There’s a much better way to make passive income from real estate, and that’s through REITs.

What is a REIT? It stands for Real Estate Investment Trust. These are companies that own and/or operate income-producing real estate.

With these, you can be more on the risky side of things and purchase individual REITs on the stock market, or be on the safer side and purchase them through an ETF (Exchange Traded Fund), which would consist of several different REITs, allowing you to invest in a diverse assortment of properties.

I have personally bought individual REITs that include dividends (as I talked about previous to this), so I get the best of both worlds. So, if this is something that interests you, combine these and you already have two ways to create passive income right there!

3. Cash Back Credit Cards

These are a great way to earn a bit of passive income, as long as you’re careful (well duh, right?). Of course we all know that credit cards are “bad debt”, but they can benefit us if we use them in the right way.

That’s where cash back credit cards come in. So, what are they exactly? Pretty much how they sound. They provide you with a percentage of cash back on your purchases. This can be either as a credit on your statement or directly into your bank account, depending on the financial institution you obtain the card from.

You earn certain percentages back for different kinds of purchases, depending on the card you choose. For example, some have a higher percentage for gas, or groceries, etc.

The redemption procedure varies with each credit card company. It may be once per month, once per calendar year or simply just anytime.

Some institutions also offer an introductory promotion that offers more of a percentage on purchases in the beginning. That’s definitely something to consider and look into.

This method, if done right, can provide you with hundreds of dollars per year in passive income. Pretty easy, hey?

Here are just a few (in Canada) to look into: BMO Cash Back Mastercard, SimplyCash Card from Amex, CIBC Dividend Visa Card and Meridian Visa Infinite Cash Back Card.

4. Blog

Starting a blog is a very inexpensive way to create passive income. However, I won’t sugar coat it, it takes work in the beginning. If you enjoy writing though, it really doesn’t feel like work.

Some people will tell you that you can’t make money blogging. Well, they would be right…if you give up on it. Many people will start a blog, write a few posts and then not see anything for that effort and give up. Or they don’t take the time to work on it. It does take time in the beginning. If you are serious about it, and take the time to put in the work (as I type this, I am up an hour before having to get ready for my day job), then you most definitely can make money…enough to quit your day job someday, if that’s what you desire.

How long does it take to start seeing success from your efforts? It will likely take anywhere from 6 months to a year, if you are consistent with it. This is why so many people give up, because they want immediate results. Like anything else in life though, you have to put in the work for the “rewards”. If you keep at it though, the rewards can be hundreds of thousands of dollars eventually.

Now, how does this fit into the passive income if you have to work so hard at it, you ask? Much of the work comes in the beginning, but eventually you can even hire someone to do the work for you down the road. There are even places like Fiverr where you can have someone inexpensively write posts for you if you so desire.

How do you get income from a blog?

– Affiliate marketing (I’ll explain that in #5)

– Write an e-Book such as Kindle and sell it on your blog

– Display ads (such as Google Adsense, etc.)

– Blog sponsorships (an advertisement on your blog, in the form of a sponsored review, etc., in exchange for money)

– Selling physical products

– Display ads (those ads you see in a website’s sidebar, for example)

– Create an online course (if you’re an expert in your niche, this can be quite profitable!)Starting a blog is very easy and inexpensive these days. You can get started using the WordPress platform to create your blog, and then some inexpensive hosting (I recommend either Host Gator or Bluehost) and a domain name (I like GoDaddy for this). Then you can start writing!

5. Affiliate Marketing

Affiliate marketing is definitely one of my favourite ways to create passive income.

What is Affiliate Marketing?

Simply put, it’s where you earn a commission for promoting other people’s products on your website or blog. For example, let’s say you have a blog. You would write a blog post inserting a link(s) to another person’s product. Your reader clicks on that link and purchases said product, and you receive a commission. Boom! Done!

This can be done on any type of website as well. Another example is that you could create a comparison website, comparing different products and then add affiliate links from Amazon directing your customer to the product.

You could also have an informational website, adding valuable information, such as articles, and add affiliate links to articles or do a review post and add them there. There are many ways to do affiliate marketing.

This is so great for passive income because you can earn commission from just one post even years down the road for little to no maintenance.

Where do you find affiliate programs?

There are many. There are programs you can join such as Clickbank, Commission Junction, Shareasale, Flex Offers and Amazon Affiliates to name just a few. If you want to promote something off someone’s website, a good idea is to check out the very bottom of their website and see if they offer an affiliate program in their menu there. That’s where many companies will list that information.

6. Dropshipping

Dropshipping is one of those somewhat unique ways to create passive income. How so, you ask?

I’ll begin by explaining what it is exactly. It’s where you sell products on your website but when someone orders a product, your manufacturer sends it directly to the customer.

It’s a great way to do e-commerce because you never have to store the products. However, before you do advertise a product, I would highly recommend just ordering one and having it shipped to you. This way, you can see what kind of quality it is, as well as knowing how well it was packaged and how long the shipping time was. All of these are very important factors for customers and for your reputation. Sound good? Great, let’s move on!

Where can you find manufacturers, you say?

There are many websites that offer dropshipping, but I like Aliexpress the most because they are free to use and offer anything and everything you can think of to sell. There are literally thousands of products on there. Sky’s the limit!

Another great thing about the manufacturers on there is that when you are going through the buying process, you have the option to send the seller a (already done for you) note not to put their company information, etc. so when your customer receives their item, they don’t know it didn’t come directly from you.

7. Cashback or Discount Apps

Remember the good ol’ days of having to sitting there clipping coupons? I bet you miss that, don’t you?

Well, technology has made saving money even easier, with cashback and discount apps. You download the free apps onto your smartphone and start saving money on purchases, such as groceries, that you would buy anyway. You can’t beat that deal!

Some of the best ones are:

Checkout 51 (grocery items)

Rakuten (formerly Ebates) (partnered with Indigo, Sportcheck, Lululemon, Walmart, The Bay, Amazon, Expedia, Bath & Body Works, etc.)

Drop (partnered with Old Navy, Sephora, Cineplex, Starbucks, etc.)

Swagbucks (partnered with Skip the Dishes, Home Depot, Carter’s, Nike, etc.) – Note: Also make money here doing surveys, watching videos, and more!

PC Optimum (for products exclusively at Superstore, Shoppers Drug Mart and other Loblaws stores)

8. High Interest Savings Account

This is definitely one of the simplest ways to create passive income, as all you need to do is open up an account and start putting money into it.

Just make sure it’s a high interest savings account as opposed to a regular savings account, so you get the biggest bang for your buck!

I find the best ones are the online banks. I have listed 5 of the best ones in this previous post.

9. Sell Stock Photos

If you enjoy taking photos, and heck, are even good at it, then this is definitely a passive income idea for you.

There are websites where you can submit your photos, and if someone purchases one, you get paid. This is passive income because people can purchase your photos again and again and again.

You will have to apply to most, if not all, photo websites and be accepted. Once you are, you submit your photos and they just have to be approved by the photo website before they go live.

Where can you submit your photos?

There are several but a few of the most popular ones are Shutterstock, iStockPhoto, Dreamstime, Adobe Stock and Getty Images.

10. Rent Out an Extra Bedroom/Basement Area

This is one of those ways to create passive income that may not be for everybody. After all, you’re letting a stranger into your home to stay for a period of time. But…

This could also be a not-so-complete-stranger in the event that you know someone, or someone of someone, that may need a temporary place to stay.

If you decide to go the Airbnb route, you can submit your listing at Airbnb.ca.

11. Write an e-Book

Have writing skills? Or maybe you are an expert in a specific area, such as home improvement, DIY, cooking/baking, finance, etc., etc., etc! The sky is the limit here really.

Don’t have writing skills, but think this is a good way to create passive income? Pay someone to write your e-Book for you. You can outsource this as smart blogger, Arman Assadi does, and he makes $2700/month doing it!

I love this idea because people could potentially be buying your e-Book for years.

I would highly recommend specifically writing a Kindle e-Book. Why? Because these are sold through Amazon and they see Amazon as being a credible source to buy from.

12. Display Ads

If you own a website or blog, or want to start one of these, display ads are a good way to earn passive income from your visitors.

What are display ads, you wonder?

As per Wikipedia’s description, display ads are “graphic advertising on Internet websites, apps or social media through banners, or other advertising formats made of text, images, flash, video and audio.”

There are many companies that offer display advertising but one of the most popular ones is Google AdSense. How AdSense works is that Google picks out your ads, which are relevant to your site’s content and they are added to your website or blog. You can even customize where they appear or remove any that you don’t like.

How does display advertising make you money?

Advertisers pay for the ads posted by Google Adsense (or whomever you use). So, when your customer clicks on the ad, the advertiser will pay you a certain amount. This amount varies depending on what each advertiser pays. You get paid per-click and per-impression.

13. Create an Udemy Course

If you are not familiar with Udemy, it is a website that sells courses on many different subjects.

If you are an expert in a particular topic, this could be a very lucrative way to create passive income. I’m not going to sugar coat it though, it will be a bit of work in the beginning, but well worth it.

Check out how 30-year-old, Phil Ebiner, makes more than six figures per year selling courses on Udemy in this Forbes article.

14. Peer-to-Peer Lending

Peer-to-peer lending is essentially a loan agreement made between you and a borrower via a third party lending platform, such as Lending Loop if you are in Canada, or Lending Club or Prosper are popular ones in the U.S.

How do you make money from peer-to-peer lending?

Simply put, you loan someone money through the lending platform of your choice, and you make money off of the interest. You can typically invest as low as $25 per loan.

Aren’t there risks to this, you ask?

Yes. You are faced with the risk that someone defaults on their loan from you. To reduce this risk, make sure you do your homework and analyze the previous history on each borrower you choose to loan money to beforehand.

15. Becoming Debt Free

So although this isn’t technically passive income, I’ve added it to the ways to create passive income list due to the simple fact that if you become debt free, you will have more money in general.

If you have debt, you are likely paying interest on that debt. So, of course, if you don’t have debt, you are not paying those interest payments anymore. Interest payments can obviously get pretty high, especially on credit cards. Once you stop paying that, you have that extra money as passive income. Pretty great, huh?

Thoughts?

So, that’s the list of ways to create passive income. Please add to this list if you have any additional ways that you personally use to make passive income. I would love to hear!

-

Update: Where I’m At & Where I’m Going

So, I thought I’d do an update post because the last one I did was all the way back in March, which was, well, months ago now. There have definitely been some changes in that time, as I’m sure there have been with you…much to do with COVID-19.

I’ll get right to it…here is where I’m at:

Current Credit Card Debt:

Mastercard #1 – PAID OFF! (In March, it was at $921.60.)

Mastercard #2 – $3942.52 (In March, it was at $5787.75.)

Gym. Due to COVID-19, my gym had closed for a couple of months. Once it re-opened, I hmm’d and ha’d over whether I should go back or not. Before the coronavirus, I was not the type to worry much about germs. Now that has changed because of the pandemic. I finally made the “executive decision” and cancelled my membership. I am now saving $47.95/month.

My boyfriend recently moved into a condo that has a much less used gym in it, so if I need to, I’ll feel better working out there. I also used to work at home with workout DVDs so I can use those. Right now, I get my cardio with frequent outdoor walks or jogs. I also have free weights and bands at home that I use for strength.

Savings. Although, I am putting the majority of any extra money into my last credit card I’m paying off, I do have a tiny bit of money socked away in a high interest savings account. I always like to have a bit of a money “cushion” so I keep a bit set aside for a just-in-case situation. Because this money sits in a high interest savings account, it generates a bit of extra moula, also known as interest.

52-Week Savings Challenge. I talked about this in a previous post. It’s a challenge that my boyfriend and I decided to do together, which is good because we remind each other each week to transfer money over to each of our high interest savings accounts (gotta make that extra interest too!).

If you’re not familiar with this challenge, how it works is you start off your first week putting in $1, then week 2 is $2, week 3 is $3, and so on, until you get to week 52 which is one year later obviously. At that point, you are sitting at a grand total of $1378!

Surveys. This is a very easy way of making a bit of extra money. It’s not a huge amount or anything but it’s so easy. Did I mention how easy it is? I make about $50/month so it pays a bill for me. It’s like free money paying that bill. That’s how I look at it anyway. I sit there and do a survey on my lunch hour, or while watching TV, or waiting in line somewhere, doctor’s office, etc.

Seeking Passive Income. I’ve recently become very interested in creating multiple streams of income, so I’ve been doing some research into passive income. So, this is the type of income that will require some work in the beginning but then not so much after that is done. I like the idea of doing this so that I can still keep my day job in the beginning. I also like the idea of making money while I sleep.

Job Hunting. I’ve been unhappy at my current job for awhile now. I put off job hunting when the pandemic first started, but recently I’ve started going hard looking and applying again. The only thing is, is that the type of job I want may be tricky to get without the proper training, which I don’t currently have. This brings me to…

Where I’m going:

Course for New Job. As I mentioned above, I need more training for the job that I want, so I recently bought a course online, inexpensively at Udemy, to get me that training. I’ll be getting started on that soon. I just have a glitch in my system that I need my brother’s help with and he’s been busy lately.

Course for a Website I Own. One of my passive income ideas that I’m interested in doing is to “resurrect” a website that I created years ago, so there’s already a lot of information (articles, etc.) on it. I just have to tweak it up a bit, get some traffic and monetize it. BUT…I want to become an expert in my niche, so I want to buy an online course to gain more knowledge on it.

The course for the new job was on sale for a very inexpensive cost, and I’ve seen a great deal on the website niche course too, so I’ll be purchasing that soon before that deal is gone.

That about sums up what’s going on with me in my world to become debt free. Please feel free to share your ideas and where you are at. Until next time…

-

5 Best High Interest Savings Accounts

When saving your money, why not have it maximized to the best of your advantage? For me, especially since the pandemic, I have done my research on different savings accounts. I thought I’d pass along my “finds” for the best high interest savings accounts here to you, so you can reap the benefits too!

1. EQ BANK – SAVINGS PLUS ACCOUNT (1.70%)

EQ Bank is a trade name of Equitable Bank who has been serving Canadians for approximately 45 years. EQ is an online only bank that makes the best high interest savings accounts list due to its great standard interest rate of 1.70%.

- No minimum balance

- Free transactions

- No everyday banking fees

- Free bill payments

- No monthly fees

- Interest rate calculated daily and paid monthly

- Free e-transfers

- Cheap international money transfers

- Interest rate is standard (non-promo)

- Free EQ to EQ transfers

- Eligible for CDIC protection on deposits (up to $100,000)

Get more details: EQ Bank

2. TANGERINE SAVINGS ACCOUNT (2.50% PROMOTIONAL)

Tangerine is owned by the Bank of Nova Scotia (Scotiabank). They launched several years ago as an online only bank. I have added them as one of the best high interest savings accounts due to their great promotional rates that they offer much of the time.

- New clients earn 2.50% from August 17, 2020 to October 14, 2020 (0.20% interest after promo)

- No unfair fees

- Zero monthly fees

- No minimum balance

- Use their Automatic Savings Program to save faster

- No service charges

- See details on their website to receive $200 (by opening a chequing account too)

- Use their Savings Calculator to calculate when you will reach your goal

- Eligible for CDIC protection on deposits (up to $100,000)

Get more details: Tangerine

3. ALTERNA BANK HIGH INTEREST eSAVINGS ACCOUNT (1.40%)

Alterna Bank is another online only bank, who has been around since 1992. They are a subsidiary of Alterna Savings, who has been around for decades. With a standard interest rate of 1.40%, they rank as offering one of the best high interest savings accounts.

- No monthly fees

- High interest rate on every dollar

- Free, unlimited bill payments, transfers and debits

- No minimum balance

- Interest paid monthly

- Free, unlimited Interac e-transfers

- Interest rate is standard (non-promo)

- Eligible for CDIC protection on deposits (up to $100,000)

Get more details: Alterna Bank

4. OAKEN FINANCIAL SAVINGS ACCOUNT (1.50%)

As part of Home Bank and powered by Home Trust Company, Oaken Financial is a very trustworthy option. At 1.50% interest, they most definitely make the list for the best high interest savings accounts.

- Zero monthly fees

- No minimum balance

- Free, unlimited transactions

- Interest calculated daily and paid monthly

- Eligible for CDIC coverage

- Interest rate is standard (non-promo)

Get more details: Oaken Financial

5. MOTUSBANK SAVINGS ACCOUNT (1.30%)

Motusbank is young but it’s backed by parent company, Meridian Credit Union, who has been around for over 75 years. Meridian Credit Union is the second largest credit union in Canada, so we know they must be quite successful.

- An always competitive rate

- No minimum balance

- Zero monthly fees

- Unlimited debit purchases and withdrawals

- Eligible deposits insured up to $100,000 by CDIC

- Free, unlimited use of their Price Drop feature (they’ll try to find you better rates on items you’ve purchased while shopping)

- Auto-Save feature allows you to round up your debit purchases and have the difference directly deposited into your savings account

- Free, unlimited transactions with their Money Mover (moving money)

Get more details: Motusbank

There you have it! I have high interest savings accounts with both Tangerine and EQ Bank. I like both but with EQ Bank, their interest rate is standard, not a promotional rate that will eventually end. So I like that aspect. However, although the rate with Tangerine is a promotional one, they tend to offer a promotion quite often. I like that too, of course.

As for the other banks that made the best high interest savings accounts list here, after doing my research on them, I think they all sound great too! You be the judge for whatever one sounds best for you. Until next time…

-

7 Ways to Get Out of Debt Quickly

We all want to kibosh our debt as quickly as we can, am I right? I know I’m always looking for ways to do so! So I came up with a great list of seven ways to get out of debt quickly. Here we go:

1. Put all extra money towards debt. Things like government refunds (tax refunds, etc.), monetary gifts, money from a pay raise, extra money once you’ve paid something off (i.e. credit card, loan, etc.), work bonus, overtime work pay and any unexpected money you may receive.

2. Lowering bills or cancelling services you don’t need/use. Do you have a gym membership you don’t use often enough? Do you have utility services you could potentially get lowered? I just recently got my internet bill lowered by $35.00 so that extra money now goes towards my credit card debt. Right now, I’m also debating my gym membership. I might just switch to working out at home.

3. Side hustles. These can be very effective ways to get out of debt quickly, as there are so many options. A few examples of things you could do: sell a service on Fiverr (there are a range of different services you could offer on Fiverr), sell photos, sell arts and crafts (on Etsy, etc.), start a YouTube channel, online tutoring, house/pet-sitting, cleaning houses, proofreading services (if you are good with grammar, spelling, etc. of course), grocery shop for people, etc…the list goes on and on!

4. Sell your stuff. We all have items in our household that we no longer use, wear, etc. In these COVID-19 times, what better time to go through all of your belongings and sell them on eBay, Amazon or an online classified website such as Kijiji or Craigslist. You’d be surprised at what people will buy secondhand. One person’s junk is another person’s treasure!

5. Pay more than the minimum payment, even if it’s just a bit. Every little bit counts. This is one of those ways to get out of debt quickly just by being focused on it. For example, for me, it was frustrating to look at my credit card statement before when I was only making the minimum payment. I thought, I’m never getting rid of this debt. Ugh. Now that I’ve really gone hard on it, that is, always putting more than the minimum payment, I’m really noticing the difference. It’s finally going down, and at the rate I want it to.

6. Track your spending and see where you can cut back or cut out completely. This can be one of the most effective ways to get out of debt quickly if you can really keep an eye on your spending. I recently went through my online banking account to see what I was spending my money on and how often, for the year so far. It’s funny how things add up, I’ll tell ya! Even the little things, like buying a coffee every day, or a bottle of wine here and there, a lunch out, etc. If I were to use the unnecessary money I had spent this year so far on my debt instead, I’d be doing even better! Baby steps. I’m learning as I go.

7. Save on groceries. We can all spend less on groceries I’m sure. A good place to start is not going shopping while hungry. Other good tips I’ve learned along the way are buy sale items of course, but stock up on them. Especially the non-perishable items. I also love buying meat in bulk when it’s a good sale, and then just popping it in the freezer. Another way to save is to go in the store with the mind frame, “I’m only buying what’s on my list, nothing more!”. I’ve always been bad with that myself, but I’ve definitely improved on it.

Imagine combining all of these ways to get out of debt quickly? You’d be well on your way most definitely! Even try doing half of them and see what a difference that makes for you. Let me know if you have other ideas of your own that are working for you. Until next time!

-

52-Week Savings Challenge

Hey you! I do a lot of reading and researching on becoming debt free, but also on easy ways to save. This may be something you already know about, but I came across this 52-week savings challenge in my recent “studies”.

I love this idea. It’s almost too easy. So, I was chatting with my boyfriend about it tonight in fact, and like me, he is all about getting out of debt and saving. As soon as I explained it to him, he was instantly on board to do this with me.

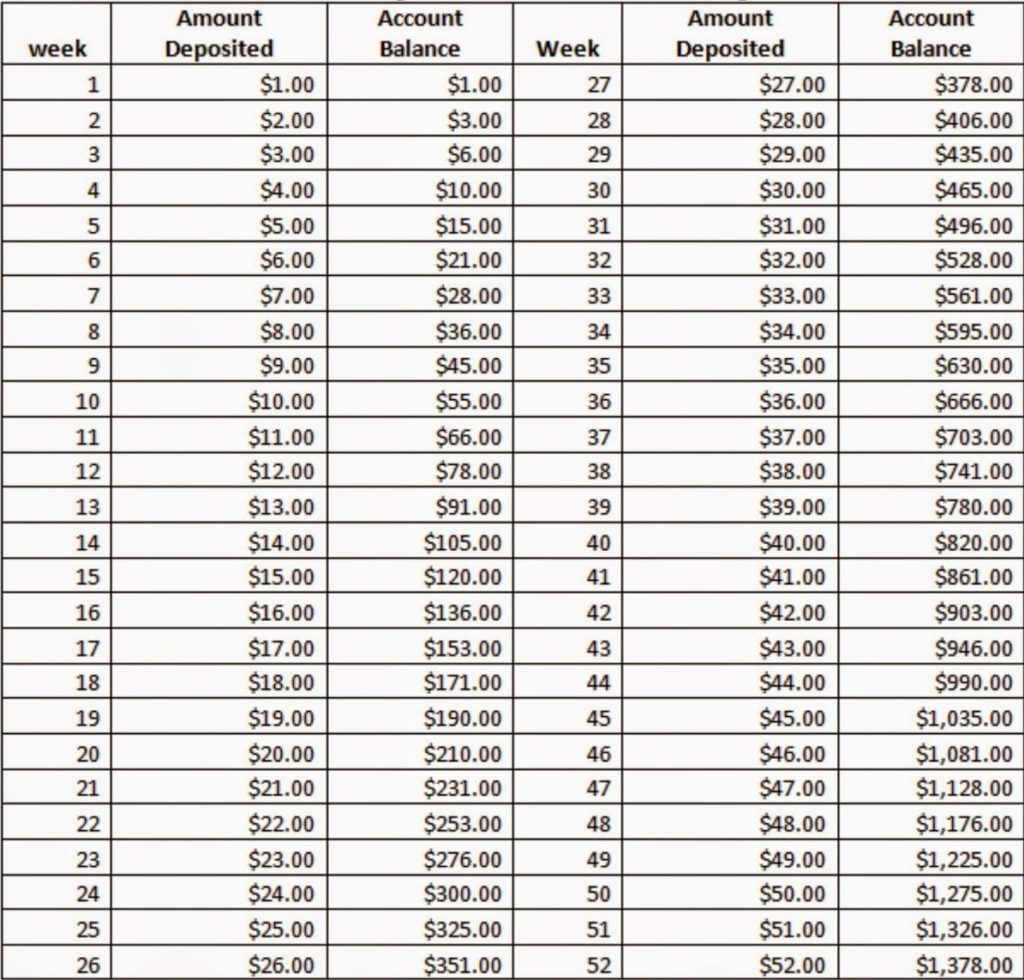

In case you haven’t heard of the 52-week savings challenge, here is a chart to show how it works:

So, Week 1, you contribute $1.00, Week 2, $2.00, and so on. At the end of the year, you’ve saved $1378.00!

Bonus: Putting that money in a high interest savings account each week, just to gain a little extra.

I find the 52-week savings challenge a very easy and doable way to save up some extra moula, while I can still go strong on paying off my credit card. The first dollar goes in today!

Have you tried this challenge and continued right to the end?